SVB Ventures Newsletter 15

SVB Ventures | Newsletter No. 15

At the one-year anniversary client meeting of SVB Ventures on August 14, 2024, we celebrated our journey in the rapidly evolving crypto investment landscape. The presentation highlighted our fund's performance over the past year, emphasizing key investments and strategic decisions that have driven our achievements. We discussed current market trends, key catalysts and our outlook on the future of crypto industry, illustrating our commitment to transformation and growth. Additionally, we outlined our approach to risk management and sustainability, ensuring our clients that we remain focused on delivering long-term value. The event served as a platform to reaffirm our dedication to transparency, collaboration and innovation in the crypto investment space.

🔸 Macro News

✔ U.S. July CPI and Retail Data

In July, the U.S. core Consumer Price Index (CPI) increased by 0.2% month-over-month, matching market forecasts, with the year-over-year CPI at 2.9% and the core CPI at its lowest since April 2021 at 3.2%.

Initial jobless claims for the week ending August 10 dropped to 227,000, the lowest in five weeks. July retail sales surged by 1% month-over-month, the most significant rise since January 2023.

QCP Capital's latest report notes that CPI data met market expectations, raising the probability of a 25 basis point rate cut by the Federal Reserve in September from 47.5% to 62.5%. However, a brief rally in stocks and cryptocurrencies was reversed following the U.S. government's transfer of 10,000 BTC to Coinbase Prime and Jump's sale of 17,000 ETH. This led to a decrease in short-term implied volatility for BTC and ETH by about 10 points, and the risk reversal indicator declined, signaling anticipated downward pressure from the increased supply.

✔ FED signaled interest cut

After a long wait, central bank rates in the U.S. now appear certain to be headed lower in September after Jerome Powell said the "time has come" for an easing in monetary policy.

At the Jackson Hole Symposium, Federal Reserve Chairman Jerome Powell stated, "My confidence has grown that inflation is on a sustainable path back to 2 percent." He further remarked, "The labor market has cooled considerably from its formerly overheated state," but clarified, "We do not seek or welcome further cooling in labor market conditions."

Powell then announced, "The time has come for policy to adjust," indicating, "The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

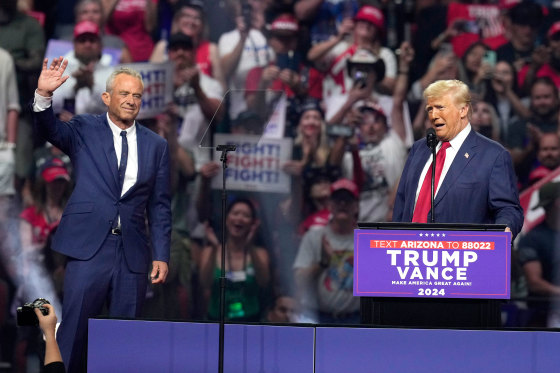

✔ Crypto Friendly RFK Jr. Drops White House Hunt, Will Lend Kennedy Name to Trump

Independent presidential candidate Robert F. Kennedy Jr., a Democrat for most of his life and a prominent member of the Kennedy family, has surprisingly dropped out of the race and endorsed Republican nominee Donald Trump. Kennedy, known for his strong support of the cryptocurrency industry, was considered the most crypto-friendly candidate in the field.

🔸 Bitcoin

✔ Mt. Gox and the US Government Pose Potential for $15 Billion Bitcoin Sell-Off

Bitcoin's recent price surge has slowed, and September could bring significant market changes. The US government and the defunct Mt. Gox exchange are poised to potentially flood the market with a combined $15 billion worth of Bitcoin, creating increased selling pressure.

The government holds around 203,000 Bitcoin ($12.1 billion), while Mt. Gox is preparing to distribute approximately 46,000 Bitcoin (over $2.7 billion) to its creditors. However, the cryptocurrency exchange Kraken appears to be managing the recent Bitcoin ETF influx without major issues. Experts believe that even with Mt. Gox's potential selling, the overall market might not experience a severe downturn.

For ten years, Mt. Gox creditors have anticipated receiving over $9.4 billion in Bitcoin, a sum that has dramatically increased due to Bitcoin's impressive 8,500% price growth. This could trigger a wave of selling as investors capitalize on their substantial gains. Interestingly, despite the significant price appreciation, many Mt. Gox creditors have not yet sold their Bitcoin holdings.

✔ Bitcoin Likely to Hold Its Horses Until After U.S. Elections, Data Indicates

Bitcoin's price tends to fluctuate significantly two to three months before US presidential elections, only to stabilize and rally after the election uncertainty settles. This pattern is attributed to the combination of year-end anxiety and election fever, which creates a volatile environment that affects not only Bitcoin but also other financial entities.

However, politics is not the only factor at play. US monetary policy, global economic conditions, and advancements in the crypto space also influence Bitcoin's price movements. The Polygon-based prediction market, Polymarket, serves as a gauge of the election's impact, with bets on each candidate adding to the market's dynamics. This complex interplay of factors contributes to Bitcoin's price volatility during the election season.

🔸 Ethereum

✔ Ethereum Gas Fees Hit 5-Year Low

Ethereum's gas fees have plummeted to their lowest levels in years, sparking speculation that the token's price may have reached a bottom. Industry experts point to the significant decrease in transaction costs as a potential indicator of a future price increase. The current low fees, which have dropped to as little as 1 gwei ($0.04), are attributed to decreased network demand, the rise of layer-2 solutions, and recent upgrades.

However, concerns about the reduced token burning and potential inflationary pressure on the ETH supply remain. While lower transaction fees benefit users, they also decrease the amount of ETH burned, which could lead to an increase in the token's supply. Historically, sharp declines in gas fees have coincided with ETH price bottoms, suggesting that the current low fees may signal a turning point for the token's price.

✔ On August 30, the total net inflow and net outflow of Ethereum Spot ETF were both $0.00, which was the first time in 30 trading days since the launch of Ethereum Spot ETF that the inflow and outflow were zero. Currently, the total net asset value of Ethereum Spot ETF is $6.971 billion, and the historical cumulative net outflow has reached $477 million.

✔ BlackRock will list its iShares Ethereum Trust (ETHA) on the Brazilian B3 exchange on Wednesday.

The ETF will trade in the form of Brazilian depositary receipts (BDRs) under the ticker ETHA39. In March this year, BlackRock's iShares Bitcoin Trust ETF (IBIT) began trading on the Brazilian stock exchange

ETF

✔ Goldman Sachs Invests Nearly Half a Billion USD in Bitcoin Spot ETFs

According to the latest 13F filing with the US Securities and Exchange Commission (SEC), Wall Street giant Goldman Sachs revealed that it holds approximately $418.65 million worth of shares in Bitcoin spot ETFs as of June 30.

The largest investment is in BlackRock's iShares Bitcoin Trust, with 6.9 million shares valued at $238.6 million. This makes Goldman Sachs the third-largest investor in the IBIT fund, behind Millennium Management and Capula Management Ltd.

Additionally, Goldman Sachs owns 1.51 million shares of Fidelity's FBTC fund worth $79.5 million, as well as 660,183 shares of Grayscale's Bitcoin ETF valued at $35.1 million.

The list of Bitcoin spot ETFs invested in by Goldman Sachs also includes $56.1 million in Invesco Galaxy's Bitcoin spot ETF, as well as stakes in other Bitcoin ETFs from Bitwise, WisdomTree, and Ark-21Shares.

✔ Morgan Stanley Holds $187 Million in IBIT in Q2

Morgan Stanley has disclosed a substantial investment in BlackRock's Bitcoin spot ETF (IBIT), holding over 5.5 million shares valued at roughly $187.79 million, making it the fifth-largest shareholder. The bank also owns a smaller stake in Ark 21Shares' Bitcoin ETF (ARKB), with 26,222 shares worth approximately $1.57 million.

However, Morgan Stanley has significantly reduced its holdings in Grayscale's Bitcoin Trust (GBTC). Its GBTC position plummeted from $270 million in the first quarter to a mere $148,000 in the second quarter, representing a nearly complete divestment (99.95% reduction). This suggests that Morgan Stanley has largely exited its GBTC investment.

- According to a recent report, 44% of institutional investors increased their holdings of Bitcoin spot ETFs in the second quarter. Meanwhile, 22% maintained their positions, 21% reduced their holdings, and 13% exited the market entirely.

✔ SEC APPROVES THE FIRST LEVERAGED MICROSTRATEGY ETF

Defiance ETFs has introduced MSTX, the first US-listed leveraged ETF specifically tracking MicroStrategy stock. MSTX aims to deliver a 175% daily return that mirrors MicroStrategy's price movements.

This new ETF could provide institutional investors with a greater leveraged exposure to Bitcoin, as MicroStrategy is a major holder of the cryptocurrency, offering them an alternative way to diversify their Bitcoin-related investments.✔ Franklin Templeton files S-1 for new crypto index ETF

Asset manager Franklin Templeton is seeking to launch a new exchange-traded fund (ETF) designed to as a one-stop-shop crypto portfolio, according to an Aug. 16 filing.

This "Franklin Crypto Index ETF" will track the CF Institutional Digital Asset Index, which currently holds only Bitcoin and Ethereum. The ETF intends to invest in these two cryptocurrencies in similar proportions to the index, with the potential to expand its holdings to include other cryptocurrencies down the line.

✔ Statistics on Bitcoin ETF Investors in the US

Four different types of investors hold significant amounts of bitcoin ETFs, including retail investors (non-filers), hedge funds, investment advisors, and brokerages.

In Q2, Investment Advisors led the way, purchasing over $1.1 billion in Bitcoin ETFs. Hedge Funds followed, investing $426 million, and Brokerages came third, with $304 million.

Although the State of Wisconsin Investment Board's (SWIB) ownership made headlines last quarter, it did not lead to an increase in pension fund ownership of bitcoin ETFs. Banks have minimal exposure to bitcoin, and our revised methodology now categorizes their wealth management arm under investment advisors. While this situation could evolve in Q3 given recent changes in access to bitcoin ETFs at firms like Morgan Stanley, as of the end of Q2, ETF ownership through this important channel remains limited.

✔ Nasdaq wants to launch a Bitcoin index options, seeks SEC approval

Bitwise Seeks Bitcoin Index Options: Bitwise aims to introduce index options tied to a Bitcoin index, providing institutions and traders with a new hedging tool. According to CIO Matt Hougan, options are crucial for normalizing Bitcoin, filling a "liquidity picture" gap. Exchange-traded fund (ETF) options would allow risk management and extended buying power.

Proposal Details and Regulatory Context: The options would be based on the CME CF Bitcoin Real-Time Index, tracking CME Group's futures and options contracts. Notably, the SEC has not approved options on spot Bitcoin ETFs, including Nasdaq's application for options on BlackRock's iShares Bitcoin Trust (IBIT) ETF. Bitwise's proposal awaits regulatory approval, potentially paving the way for enhanced Bitcoin market infrastructure and institutional adoption.

✔ Second Solana ETF Approved in Brazil

The Brazilian Securities Commission (CVM) has given the green light to a second Solana ETF fund within a week. While Solana-focused investment products are gaining traction in Brazil, their future in the U.S. remains uncertain.

The latest Solana ETF, approved on Tuesday by the CVM, will be managed by Hashdex, a Brazilian asset management firm. Currently, the fund is in its pre-operational phase. This follows the approval of Brazil's first Solana ETF earlier this month, created by QR Asset Management and administered by Vortx.

✔ SEC APPROVES THE FIRST LEVERAGED MICROSTRATEGY ETF

Defiance ETFs has introduced MSTX, the first US-listed leveraged ETF specifically tracking MicroStrategy stock. MSTX aims to deliver a 175% daily return that mirrors MicroStrategy's price movements.

This new ETF could provide institutional investors with a greater leveraged exposure to Bitcoin, as MicroStrategy is a major holder of the cryptocurrency, offering them an alternative way to diversify their Bitcoin-related investments.

✔ Franklin Templeton files S-1 for new crypto index ETF

Asset manager Franklin Templeton is seeking to launch a new exchange-traded fund (ETF) designed to as a one-stop-shop crypto portfolio, according to an Aug. 16 filing.

This "Franklin Crypto Index ETF" will track the CF Institutional Digital Asset Index, which currently holds only Bitcoin and Ethereum. The ETF intends to invest in these two cryptocurrencies in similar proportions to the index, with the potential to expand its holdings to include other cryptocurrencies down the line.

✔ Statistics on Bitcoin ETF Investors in the US

Four different types of investors hold significant amounts of bitcoin ETFs, including retail investors (non-filers), hedge funds, investment advisors, and brokerages.

In Q2, Investment Advisors led the way, purchasing over $1.1 billion in Bitcoin ETFs. Hedge Funds followed, investing $426 million, and Brokerages came third, with $304 million.

Although the State of Wisconsin Investment Board's (SWIB) ownership made headlines last quarter, it did not lead to an increase in pension fund ownership of bitcoin ETFs. Banks have minimal exposure to bitcoin, and our revised methodology now categorizes their wealth management arm under investment advisors. While this situation could evolve in Q3 given recent changes in access to bitcoin ETFs at firms like Morgan Stanley, as of the end of Q2, ETF ownership through this important channel remains limited.

✔ Nasdaq wants to launch a Bitcoin index options, seeks SEC approval

Bitwise Seeks Bitcoin Index Options: Bitwise aims to introduce index options tied to a Bitcoin index, providing institutions and traders with a new hedging tool. According to CIO Matt Hougan, options are crucial for normalizing Bitcoin, filling a "liquidity picture" gap. Exchange-traded fund (ETF) options would allow risk management and extended buying power.

Proposal Details and Regulatory Context: The options would be based on the CME CF Bitcoin Real-Time Index, tracking CME Group's futures and options contracts. Notably, the SEC has not approved options on spot Bitcoin ETFs, including Nasdaq's application for options on BlackRock's iShares Bitcoin Trust (IBIT) ETF. Bitwise's proposal awaits regulatory approval, potentially paving the way for enhanced Bitcoin market infrastructure and institutional adoption.

✔ Second Solana ETF Approved in Brazil

The Brazilian Securities Commission (CVM) has given the green light to a second Solana ETF fund within a week. While Solana-focused investment products are gaining traction in Brazil, their future in the U.S. remains uncertain.

The latest Solana ETF, approved on Tuesday by the CVM, will be managed by Hashdex, a Brazilian asset management firm. Currently, the fund is in its pre-operational phase. This follows the approval of Brazil's first Solana ETF earlier this month, created by QR Asset Management and administered by Vortx.

🔸 Crypto Policies & Regulations

✔ Dubai has approved the payment of salaries in cryptocurrency following a landmark court ruling

In a legal case, an employee asserted claims for unpaid wages, wrongful termination, and additional benefits. The employment contract stipulated a monthly salary in traditional currency along with 5,250 EcoWatt tokens, a type of cryptocurrency. The court decided in favor of the employee, mandating that the employer pay the outstanding salary in EcoWatt tokens, as the employer could not prove that the payment had been made. The employer contended that the termination was justified and that the token payments were not legally binding, but the court upheld the contract's provisions.

This decision emphasizes the importance of explicit contractual agreements and illustrates the UAE's openness to contemporary financial practices. Moreover, it reflects the country's forward-thinking approach to incorporating and regulating the cryptocurrency industry.

✔ Russia to launch crypto exchanges for global trade in Moscow and St Petersburg, planning to use Cryptocurrencies for International Trade Amid Western Sanctions Starting on September

Russia is establishing two crypto exchanges in Moscow and St. Petersburg to facilitate international trade, as reported by Kommersant on August 23. The exchanges will initially serve a limited number of users but will eventually be available to major firms, including exporters and importers.

The Russian State Duma has passed a bill allowing businesses to use cryptocurrencies like Bitcoin for international trade, expected to come into effect in September 2024. This move aims to mitigate the effects of Western sanctions by bypassing traditional financial systems like SWIFT.

The adoption of cryptocurrencies could stabilize or boost Russia's trade with countries accepting them, providing an alternative to the dollar and euro. However, it also poses risks related to cryptocurrency volatility and regulatory uncertainties, which may impact the effectiveness of this new trade finance mechanism.

✔ El Salvador launches Bitcoin certifications for civil servants

El Salvador has introduced a Bitcoin certification program aimed at educating 80,000 government employees in strategic management and public policy related to Bitcoin.

This effort, spearheaded by the National Bitcoin Office, seeks to bolster the country's Bitcoin-focused economy and improve its governance standards.

✔ Hong Kong Monetary Authority Launches Tokenization Sandbox, Drawing Interest from Major Institutions

The Hong Kong Monetary Authority has launched its "Project Ensemble" sandbox, a tokenization platform that aims to build a grand architecture for Hong Kong's tokenization market. Major institutions, including HSBC, Global Shipping Business Network, and HashKey Group, have already begun testing proofs of concept within the sandbox.

The tests have included various scenarios, such as purchasing digital bonds on HSBC's Orion platform, interbank transfers of tokenized deposits between HSBC and Hang Seng Bank, and settlements of electronic bills of lading. The sandbox aims to facilitate tokenized transactions at scale and at high speed, helping to future-proof the financial system in Hong Kong.

✔ Singapore has emerged as the global leader in crypto adoption

A recent study ranked 28 countries with investment migration programs based on their crypto-friendliness, with Singapore emerging as the top destination with a score of 45.7 out of 60. Hong Kong and the UAE followed closely, with scores of 42.1 and 41.8, respectively. These countries excelled in areas such as economic factors, tax-friendliness, and digital infrastructure, making them attractive locations for crypto investors.

The United States ranked fourth in the Henley Crypto Adoption Index, scoring 41.7 points. While the country boasts a strong fintech ecosystem and high public adoption, its regulatory environment was cited as a challenge for broader adoption. Despite this, the US remains a significant player in the global crypto landscape, with its innovation and technology driving growth in the sector. The report highlights the importance of a supportive regulatory environment in fostering crypto adoption, and the US's complex regulatory landscape may impact its ability to attract crypto investors.

🔸 Other News

✔ MetaMask has begun the rollout of a blockchain-based debit card, developed in collaboration with Mastercard.

The digital asset wallet MetaMask is partnering with Mastercard and the Web3 payment financial company Baanx to introduce a blockchain-based debit card. Initially, the card will be available for testing by a select group of users in Europe and the UK.

This debit card will allow users to make payments directly using assets stored on the Linea blockchain, an Ethereum Layer 2 network, including USDC, USDT, and wETH. The full rollout of the card is expected across the EU and the UK later this year, with plans to gradually expand to other regions.

✔ USDT Tether produced an estimated $6.2 billion in net income in 2023.

Tether, with just around 100 employees, generated 78% of Goldman Sachs' revenue ($7.9 billion) and 72% of Morgan Stanley's ($8.5 billion). In contrast, Goldman Sachs employs 49,000 people, and Morgan Stanley has 82,000, underscoring Tether's exceptional efficiency and profitability compared to these much larger financial institutions.

✔ Telegram founder Pavel Durov arrested in France

Pavel Durov, the founder and CEO of Telegram, was arrested at Le Bourget airport in France after a French search warrant, issued by the Office of the French National Judicial Police Directorate (OFMIN), led to his detention. Durov, listed in the Wanted Persons File (FPR), faces serious allegations related to Telegram's role in facilitating illegal activities such as drug trafficking, child abuse, and fraud due to its lack of content moderation and use of cryptocurrencies. Following his arrest, Durov was placed in custody by the National Anti-Fraud Office (ONAF) and is expected to face multiple charges, including terrorism, drug trafficking, and money laundering.

Durov has since been released on €5 million bail and placed under judicial supervision, with restrictions on leaving French territory and reporting requirements.

Durov’s arrest has prompted reactions from free speech advocates and tech industry figures. Many criticize the arrest as a violation of human rights and question whether other social media platforms’ leadership would also be held responsible for misuse by bad elements.

Some suggested that French authorities are trying to control or access communications on Telegram. However, French President Emmanuel Macron clarified that Durov’s arrest was part of a judicial process with no political motivations behind it.

Meanwhile, the TON community has set up a DAO to advocate for his freedom and published an open letter calling for his release.

✔ PayPal partners with crypto platform Anchorage

PayPal has teamed up with Anchorage Digital, the first licensed cryptocurrency bank, to introduce a stablecoin rewards program for holders of its USD-pegged stablecoin, PYUSD. The program will offer rewards in PYUSD to users who keep their stablecoins in Anchorage's wallet or at the crypto bank, without the need for lending their assets.

PYUSD has already exceeded a $1 billion market capitalization, with a substantial amount circulating on the Solana blockchain. Over $647 million in PYUSD is currently in use on Solana, a notable figure considering PayPal only began issuing its stablecoin beyond Ethereum on May 29. The rewards program is financed by Anchorage Digital, with returns generated from underlying holdings, and will be distributed in PYUSD.

✔ Binance and its CEO, Changpeng Zhao, have been sued in federal court in Seattle by a class of plaintiffs.

The lawsuit, led by prominent class action attorneys, accuses Binance of facilitating money laundering that harmed consumers. The plaintiffs claim that cryptocurrency lost in hacks and thefts was laundered through Binance, which allegedly encouraged these activities as part of its profit-driven business model. They argue that Binance's role in money laundering constitutes illegal extortion under the RICO Act, potentially leading to treble damages.

CZ, who is currently in a residential program preparing for release, is expected to regain his freedom on September 29. He will then be banned from operating or managing Binance for three years as part of the settlement. After his release, CZ plans to return to Dubai, but will still be under the supervision of the U.S. government.

✔ OpenSea Gets 'Wells Notice' From SEC, Which Calls NFTs Sold on Platform 'Securities'

Non-fungible token (NFT) marketplace OpenSea announced on Wednesday that it has received a Wells notice from the U.S. Securities and Exchange Commission (SEC), indicating the regulator's intent to pursue an enforcement action.

"OpenSea has received a Wells notice from the SEC threatening to sue us because they believe NFTs on our platform are securities," OpenSea's CEO Devin Finzer wrote on the social media platform X.

"We're shocked the SEC would make such a sweeping move against creators and artists. But we're ready to stand up and fight," he added.

Finzer stated that his company will contest the notice and pledged $5 million to assist with legal fees for any NFT creators and developers who may also receive such a notice.

Nhận xét

Đăng nhận xét