SVB Ventures Newsletter No. 16

SVB Ventures | Newsletter No. 16

Token2049 Singapore - September 2024 witnessed unprecedented growth with over 20,000 attendees and 800 side events. This demonstrates the growing prominence and maturity of the crypto and Web3 space. The event served as a central hub for knowledge sharing, networking, and deal-making within the industry. SVB team spent the whole week in Singapore meeting old friends and networking with new ones. We exchanged ideas, perspectives, deal flows & collaboration opportunities.

While acknowledging the recent temporary downturn, a sense of optimism and resilience within the community, from VCs & Funds, Family Offices, Projects & other industry stakeholders was palpable. The event served as a platform to showcase innovative projects and foster collaborations, indicating a belief in the long-term potential of the industry. The focus shifted towards building and innovating, rather than solely focusing on short-term price fluctuations. Token2049 also featured a diverse range of speakers and attendees from various backgrounds, contributing to a rich and multifaceted dialogue. Panels and discussions included perspectives from technologists, policymakers, investors, and community leaders.

🔸 Below are our Key Takeaways highlighting emerging trends and focus areas:

1. Industry Growth and Adoption:

Token2049 Singapore highlighted significant growth in the blockchain and cryptocurrency industry, with a focus on mainstream adoption and institutional participation. Speakers discussed the increasing interest from traditional financial institutions in blockchain technology and digital assets.

2. Technological Innovations

- AI and its integration with blockchain dominated conversations: Multiple conversations highlight the significant buzz surrounding Artificial Intelligence and its applications within the blockchain space. This included discussions on Decentralized AI, AI-powered trading tools, the use of AI in decentralized finance (DeFi), and the potential for AI to improve various aspects of blockchain technology. The integration of AI and blockchain was clearly a major theme.

- Real-World Assets (RWAs): There was significant interest in RWAs, representing the bridge between traditional finance and blockchain technology. While RWAs face regulatory challenges, the industry's focus on them suggests a maturing market that recognizes their value. Read more on SVB latest Insights on RWA narrative here: https://x.com/SVB_Ventures/status/1835519590480445623

- DePIN (Decentralized Physical Infrastructure Networks): The buzz around DePIN signifies the industry's continuous drive for innovative solutions. This topic garnered considerable attention as a promising solution to revolutionize infrastructure networks. The concept of leveraging blockchain technology to create decentralized, community-owned networks for resources like internet connectivity, energy, and storage resonated strongly.

- Layer 1 Scalability & Interoperability: There was a strong emphasis on Layer 1 blockchains achieving higher transaction speeds and enabling seamless interaction between different networks. Several emerging Layer 1 blockchains showcased their unique value propositions and technological advancements. Existing Layer-1s like Solana also highlighted significant upgrades and new features aimed at enhancing their capabilities.

- Layer-2 scaling solutions received considerable attention: The importance of improving scalability on existing blockchains was a recurring theme. Discussions focused on the effectiveness of Layer-2 solutions in addressing transaction speed and cost issues, which are crucial for wider adoption.

The ongoing regulatory landscape and its implications for the future of crypto were prominent topics. Concerns about regulatory uncertainty and its potential to stifle innovation were expressed. The conversations suggest a general feeling of anticipation and cautious optimism regarding future regulatory frameworks. There was a strong emphasis on the need for clear and consistent regulatory frameworks to foster innovation while ensuring consumer protection.

4. Security and Risk Management:

Security best practices and risk management strategies were among key topics, reflecting the industry's ongoing efforts to build trust and mitigate vulnerabilities. Speakers shared insights on emerging threats and the importance of continuous security audits and updates.

5. User Experience and Accessibility:

Improving user experience and making blockchain technology more accessible to a broader audience was a recurring theme. Innovations in user interfaces, onboarding processes, and educational resources were highlighted.

6. Sustainability:

The environmental impact of blockchain, particularly proof-of-work (PoW) consensus mechanisms, was a topic of discussion. Solutions and initiatives aimed at making blockchain more sustainable, such as transitioning to proof-of-stake (PoS) and other energy-efficient protocols, were highlighted.

7. Global Collaboration:

The importance of global collaboration and cross-border cooperation was emphasized to address challenges and drive the industry forward. Panels and sessions discussed the role of international partnerships in fostering innovation and standardization.

8. Community and Ecosystem Building:

Token2049 Singapore underscored the significance of building robust communities and ecosystems around blockchain projects. Initiatives to support developers, entrepreneurs, and investors were discussed, including mentorship programs and funding opportunities.

9. Future Outlook:

Optimism about the future of blockchain and cryptocurrency was prevalent, with many speakers predicting continued growth and widespread adoption. The event concluded with a call to action for the community to stay innovative, collaborative, and focused on long-term sustainability.

Overall, Token2049 Singapore provided SVB a significant opportunity for networking and community building within the crypto space. The event also gave us valuable insights into the current state and future direction of the cryptocurrency industry. It clearly served as a valuable platform for connecting investors, developers, and enthusiasts.

🔸 Macro Highlights

✔ FED cut rate. Markets react positive.

On 18 Sep, The US Federal Reserve's FOMC started a new easing cycle by cutting the federal funds rate by 50 basis points to 4.75–5.00%, the first reduction since March 2020. FED Chair Jerome Powell emphasized a cautious, meeting-by-meeting approach, highlighting a strong economy with solid growth and decreasing inflation. He stated the FED is not rushing to ease policy, as an economic downturn is unlikely.

FOMC members have projected additional rate cuts of 25 bps in November and December, followed by a 100 bps reduction in 2025 and another 50 bps cut in 2026. This would bring the federal funds rate to a range of 2.75% - 3.00% by the end of the easing cycle. Powell highlighted that the goal is to achieve price stability without causing a significant increase in unemployment.

✔ In the past week, the Chinese government has implemented a range of stimulus measures aimed at bolstering its stock and housing markets:

- Liquidity injections into the stock market: The People's Bank of China (PBOC) has provided 500 billion yuan in liquidity support to funds and brokers to encourage stock purchases.

- Interest rate cuts: The PBOC has cut short-term interest rates and the reserve requirement ratio for banks, aiming to boost lending and stimulate economic activity.

- Easing of mortgage restrictions: Major cities like Beijing, Shanghai, and Guangzhou have relaxed restrictions on home purchases, including lowering down payment requirements for second homes.

As a result:

- Chinese stocks up +6% today and +18% in 5 days

- Beijing 50 index posts RECORD +15% intraday jump

- RECORD 1 trillion Chinese Yuan traded in 30 minutes

- Brokerages open 24/7 to accommodate retail traders

- Commerce Ministry says it will "improve policy effectiveness"

- Chinese brokerages crashing due to high traffic!

This Chinese stimulus and stock rally create a positive backdrop for the crypto industry. While the impact is largely indirect, the improved economic outlook, increased risk appetite, and potential capital flow can all contribute to a favorable environment for cryptocurrencies.

🔸 Bitcoin

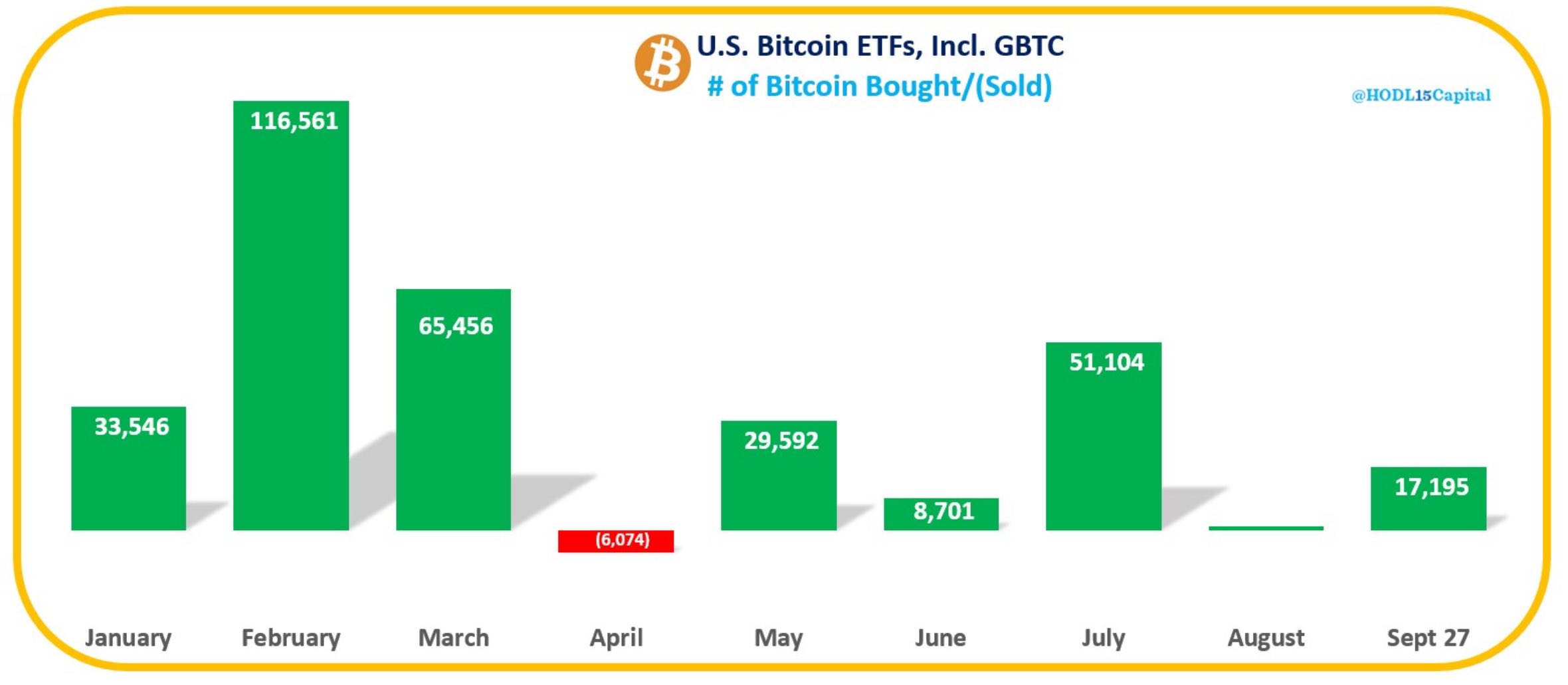

✔ US investors showed increased demand for the spot Bitcoin ETFs during the entire last trading week, with almost $1.2 billion entering the 11 such US-based funds. The additions marked the third consecutive week of inflows and were attributed to expectations of further interest-rate cuts in the U.S.

Interestingly, the interest for their spot Ethereum counterparts has also picked up, as they registered their second-best week since going live in July.

Bitcoin may be on the verge of a significant price surge in Q4 2024 or latest Q1 2025. A convergence of technical indicators suggests an impending breakout, with Bitcoin's price action resembling a "ticking time bomb."

Historically, periods of extreme fear in the market have often preceded Bitcoin's most impressive rallies, indicating a potential turning point where selling pressure subsides. Additionally, the global liquidity index hints at a growing influx of capital into riskier assets like Bitcoin, further supporting the possibility of a price increase.

🔸 Ethereum

✔ Andrew Vranjes, Deputy Chairman of Blockdaemon, announced that Hong Kong regulators might approve staking features for Ethereum ETFs this year as the region aims to become a crypto hub. His team is collaborating with ETF issuers to develop staking solutions and has made significant progress in discussions with local regulators, engaging clients and authorities through detailed documentation.

🇭🇰Despite initial hype, Hong Kong's spot cryptocurrency ETFs have underperformed compared to their US counterparts. Industry experts believe that potential staking features for Ethereum spot ETFs could offer a competitive edge. Hong Kong's ETF liquidity is significantly lower than in the US, with just $390,000 in trading volume for three Ethereum ETFs on Monday, while 9 US ETFs recorded $129 million in volume and $9.5 million in daily net outflows. Vranjes predicts an announcement on Ethereum staking for Hong Kong ETFs could precede the US.

🔸 Crypto Policies & Regulations

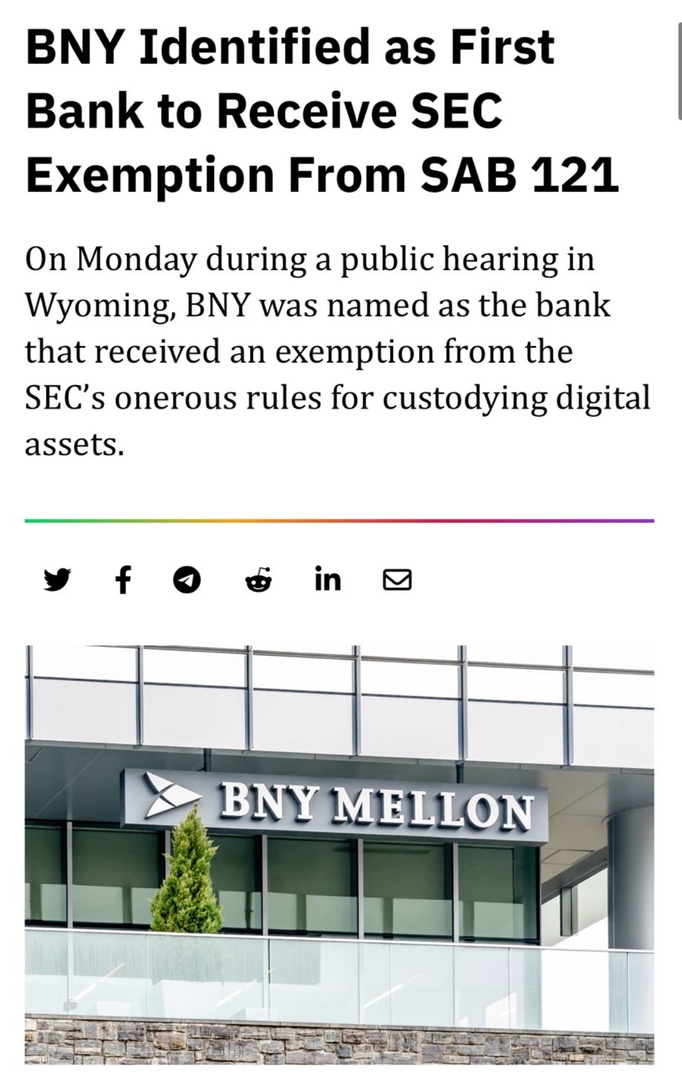

✔ BNY Mellon has received a favorable review from the SEC's Office of the Chief Accountant, allowing it to provide cryptocurrency custody services for its ETF clients' Bitcoin and Ether holdings without adhering to the controversial SAB 121 accounting guidelines.

This is significant because:

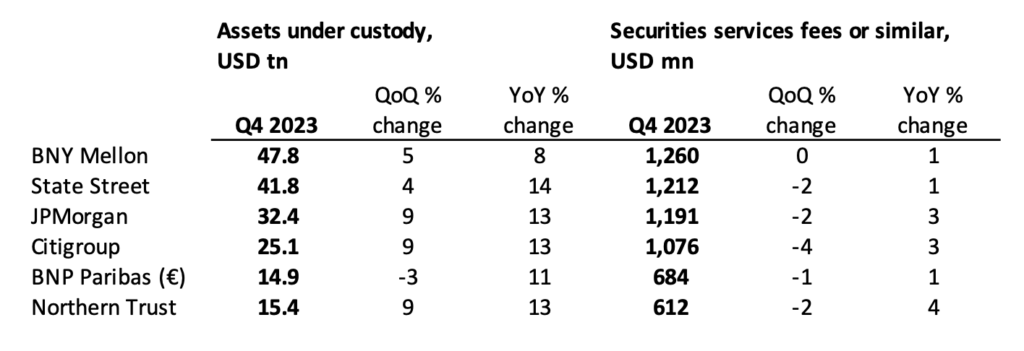

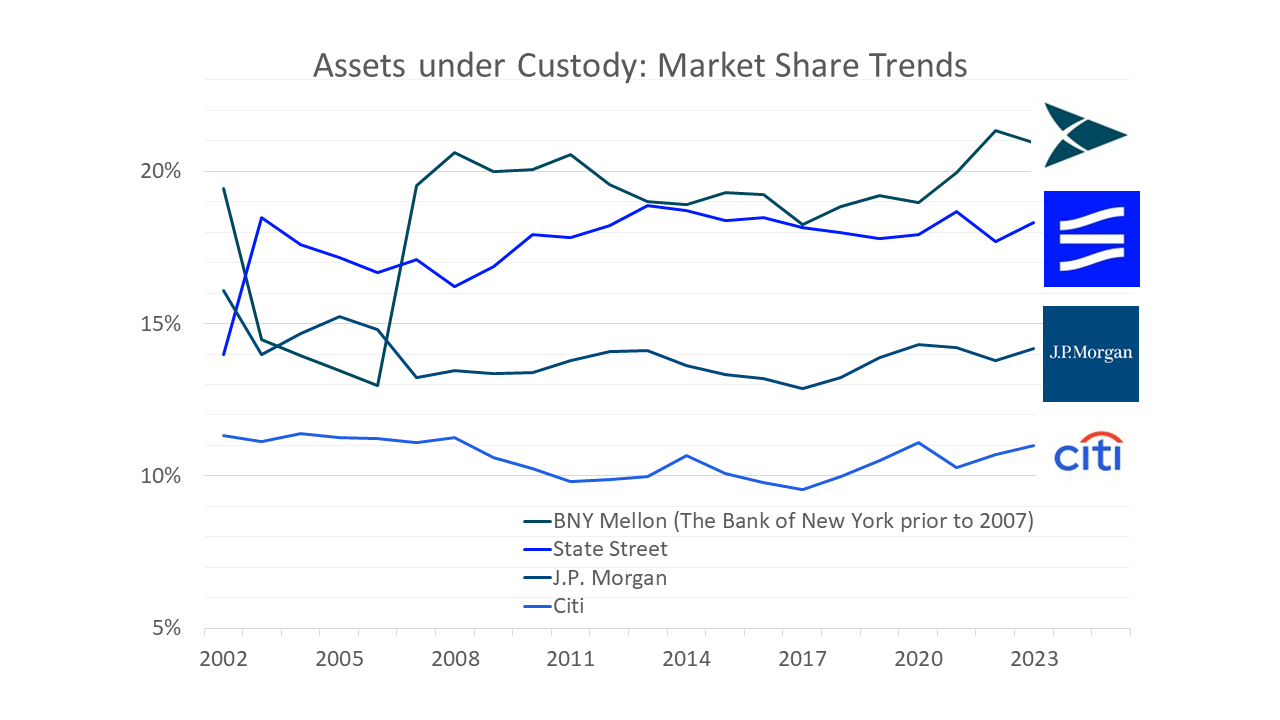

- As of today, BNY Mellon holds the title of the world's largest custodian bank, with $48.8 trillion in assets under custody. Other major banks like State Street and JPMorgan Chase are also significant players in the custody space. However, BNY Mellon's current position as the largest custodian bank underscores its prominence in the global financial services industry.

- SAB 121 has been a major hurdle for banks wanting to offer crypto custody services. The rule requires companies holding customers' cryptocurrencies to record them as liabilities on their balance sheets, which can be problematic due to the volatile nature of crypto assets.

- The exemption granted to BNY Mellon sets a precedent. It signals that the SEC might be open to providing similar exemptions to other financial institutions, potentially paving the way for greater institutional adoption of cryptocurrencies.

- This development challenges Coinbase's current dominance in the crypto custody market. BNY Mellon, with its established reputation and extensive network, could attract significant institutional clients seeking secure and regulated crypto custody solutions.

However, there are also some concerns:

- The exemption is specific to BNY Mellon's use case for ETPs. It's unclear whether other asset managers or banks offering crypto investment products will be granted similar exemptions.

- The SEC's decision has sparked accusations of favoritism. Some lawmakers have questioned the transparency and fairness of the process, raising concerns about potential regulatory capture.

Overall, the SEC's decision to exempt BNY Mellon from SAB 121 is a major development in the crypto custody space, potentially opening the door for greater institutional participation and mainstream adoption. However, it also raises questions about regulatory clarity and the potential for preferential treatment.

✔ Speaking in an interview on CNBC’s Squawk Box on Sept. 26, Gensler reinforced the SEC’s position that Bitcoin remains a commodity under US law. He said: “As it relates to Bitcoin, my predecessor and I have said that’s not a security.”

Gensler’s approach to regulating crypto has drawn criticism from members of Congress. US policymakers, particularly in the House of Representatives, have accused Gensler of creating confusion by coining terms like “crypto asset security” in legal actions.

During a recent congressional hearing, lawmakers expressed frustration over the SEC’s handling of crypto regulations, with some arguing that the agency has stifled innovation. Other SEC Commissioners, including Hester Peirce and Mark Uyeda, endorsed the critique, saying the regulator has failed to provide clarity despite having the tools to do so.

✔ A digital asset lobby group backed by Coinbase, Stand With Crypto, has been forced to change its crypto-friendly ranking of Democratic presidential candidate Kamala Harris. The group, which runs a website that ranks the level of support U.S. politicians have shown for crypto, had characterized Harris as “Supports Crypto,” giving her a “B” grade.

The ranking followed remarks the Vice President made on September 22 at a New York fundraiser. She said she would encourage innovative technologies, including artificial intelligence and digital assets. She also promised to cut unnecessary bureaucracy, which many feel has been a hallmark of crypto regulation in the United States.

Stand With Crypto determined that the statement was “somewhat supportive” of the industry and upgraded Harris’ card on its website, giving it the second highest grade achievable.

For context, the same website has given Donald Trump an “A” grade, signifying him as being “strongly supportive” of digital assets. The Republican flagbearer has reportedly made at least 21 statements on crypto compared to just one made by his opponent in the U.S. presidential race.

✔ Today, China's former minister of finance, Zhu Guangyao, said at a forum hosted by Tsinghua University that the government should study crypto more closely, given remarks made on the U.S. campaign trail. Crypto "has negative impacts, and we must fully recognize its risks and the harm it poses to capital markets" Sina News quoted him as saying. "However, we must also study the latest international changes and policy adjustments, as it is a crucial aspect of digital economy development."

✔ 🇩🇪 Germany’s major banks, Commerzbank and DZ Bank, are launching Bitcoin and crypto trading services in response to rising institutional demand. Commerzbank has partnered with Deutsche Börse’s Crypto Finance to provide corporate trading access, while DZ Bank is collaborating with Boerse Stuttgart to enable crypto trading for its 700 cooperative banks.

🇩🇪DZ Bank and Commerzbank, together managing over $1 trillion in assets, are expanding mainstream access to Bitcoin in Europe’s largest economy. DZ Bank’s head of trading noted that professional investors are quickly allocating to Bitcoin and crypto, emphasizing the need for regulated services for portfolio diversification and risk management. These moves mark a significant milestone in Bitcoin’s integration into European finance, pushing it further into the mainstream.

✔ 🇸🇬DBS Bank in Singapore will become the first Asian-headquartered bank to offer OTC crypto options and structured notes linked to Bitcoin and Ethereum, starting in Q4 2024. These products, available to eligible institutional and accredited private banking clients, expand DBS's existing digital asset services on its DDEx platform.

🇸🇬 The new offerings enable investors to earn yield on fiat, take delivery of crypto, and allow Bitcoin and Ethereum holders to hedge against volatility and generate returns through options strategies. This addresses growing institutional demand for digital assets, providing sophisticated investment tools and secure access within a trusted banking environment. DBS has already seen significant growth in its digital asset trading volumes and custody services this year.

✔ Hong Kong looks to become global OTC crypto center with new EU style reporting

Hong Kong’s financial regulators have announced plans to harmonize the city’s over-the-counter (OTC) derivatives reporting regime, including crypto derivatives, with international standards. The Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC) released a joint consultation conclusion outlining changes that will bring the city’s regulations in line with European and global practices.

The new rules, set to take effect on September 29, 2025, will mandate the use of Unique Transaction Identifiers (UTI), Unique Product Identifiers (UPI), and Critical Data Elements (CDE) for OTC derivatives reporting. These changes aim to facilitate international standardization and harmonization of data elements reported across global OTC derivatives reporting regimes.

✔ 🇧🇷 🇲🇽 Circle's USDC stablecoin is now integrated with Brazil and Mexico's real-time payment systems, allowing businesses direct access to USDC via local banks, eliminating the need for international wire transfers. This integration enables both corporate use and retail availability of the stablecoin within these countries. The integration makes USDC available in local fiat currencies, such as the Brazilian Real (BRL) and the Mexican peso (MXN). It also means a digital dollar integrated into Brazil’s PIX and Mexico’s SPEI, popular real-time payment systems.

🇧🇷🇲🇽Circle's USDC integration with Brazil's PIX and Mexico's SPEI, popular real-time payment systems, aims to capture a larger share of the cross-border transactions market, a key stablecoin use case. This move leverages the widespread adoption of PIX (168M+ users) and the established presence of SPEI in Mexico, positioning USDC for increased usage within these rapidly growing digital payment ecosystems.

✔ Binance founder Changpeng “CZ” Zhao has been released from prison, according to the U.S. Bureau of Prisons (BOP).

CZ’s release comes two days ahead of his scheduled release date this Sunday, Sep. 29. The BOP is legally allowed to release prisoners early if their release date falls on a weekend or holiday. CZ's release from prison carries significant value and implications for the crypto community as he is a highly influential figure in the space. His return could signal a degree of regulatory clarity or at least a normalization of crypto's place within legal frameworks, boosting overall market confidence.

Nhận xét

Đăng nhận xét