SVB Ventures Newsletter No. 17

SVB Ventures | Newsletter No. 17

On its 16th anniversary, Bitcoin's journey is marked by remarkable growth and evolution. From its humble beginnings as a cypherpunk concept in a 2008 whitepaper, Bitcoin has defied expectations, weathering booms and busts to become a recognized global asset. Early adoption was driven by tech enthusiasts and libertarians, but gradually, institutional interest grew, culminating in the recent landmark approval of spot Bitcoin ETFs. This mainstream acceptance, alongside its resilience against economic uncertainty and technological innovation like the Lightning Network, solidifies Bitcoin's position as a pioneer in the evolving landscape of finance and technology. Despite challenges and controversies, Bitcoin's enduring legacy on its 16th anniversary is undeniable, with its future potential remaining a topic of intense interest and speculation.

🔸 Macro News

✔ a16z Crypto released a report saying that as of September 2024, there were about 617M cryptocurrency holders worldwide and 60M monthly active users. The transaction volume of stablecoins in the Q2 - 2024 was more than twice that of Visa. The average cost of sending USDC on Base is less than one cent, compared to an average cost of $44 for sending international wire transfers.

7 key takeaways:

- Crypto activity and usage hit all-time highs

- Crypto has become a key political issue ahead of the U.S. election

- Stablecoins have found product-market fit

- Infrastructure improvements have increased capacity and drastically reduced transaction costs

- DeFi remains popular — and it’s growing

- Crypto could solve some of AI’s most pressing challenges

- More scalable infrastructure has unlocked new onchain applications

✔ On 11 October, The Mt. Gox trustee postponed the deadline to repay creditors by one year to October 31, 2025.

Crypto wallets associated with Mt. Gox still hold $2.8 billion worth of Bitcoin after distributing about $6 billion worth of assets to creditors earlier this year.

🔸 Bitcoin

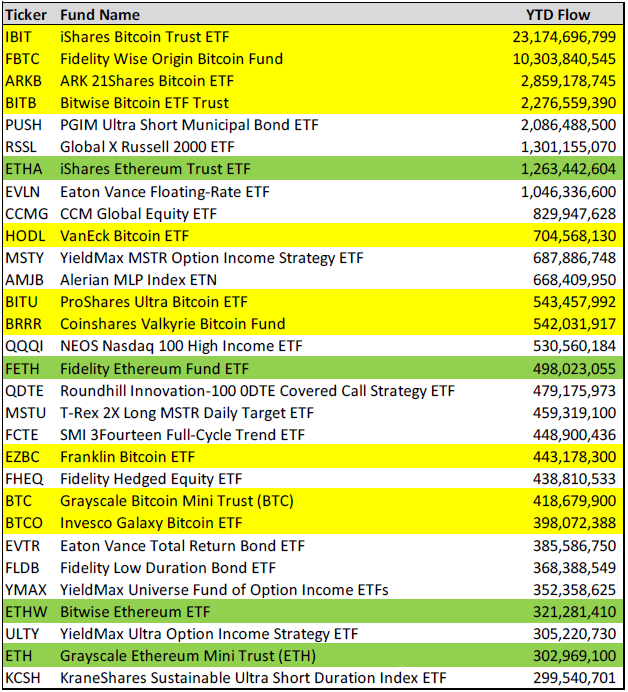

BTC spot ETFs have recorded inflows in the last 4 weeks, respectively $348.4M, $2.129B , $997.6M and the latest is $2.22B. Last week inflow was also the 4th best week in history, only behind peak period February - March this year. Bloomberg data showed that among the 575 ETFs issued in 2024, Bitcoin and Ethereum ETF products occupy 14 of the top 30, with Bitcoin ETFs taking the top 4 spots. BlackRock's iShares Bitcoin Spot ETF set a record for the largest inflow of funds among 1,800 newly issued ETFs in the past 4 years

Bitcoin price also had a great start to the week, soaring from $67,500 region to $73,600 - just $100 below its ATH in March 2024.

BTC closed the October candle with +10.76%, ready for the important November with the next Fed interest rate adjustment, as well as the results of the 2024 US Presidential election. We expect more market volatility as moving closer to US Election date.

✔ MicroStrategy plans $42 billion bitcoin expansion with bold ’21/21 Plan’

MicroStrategy has unveiled a bold three-year plan to raise $42 billion in capital aimed at expanding its Bitcoin holdings significantly, according to an Oct. 30 statement.

Dubbed the “21/21 Plan,” this strategy intends to gather $21 billion from equity and an additional $21 billion through debt, with the funds directed toward increasing the company’s Bitcoin treasury.

MicroStrategy’s President and CEO Phong Le shared insights into the company’s intentions, stating that the firm is focused on increasing shareholders’ value by leveraging the digital transformation of capital.

Early October, its founder Michael Saylor said that MicroStrategy's ultimate goal is to become a leading Bitcoin bank. Its core business is to create Bitcoin capital market instruments covering stocks, convertible stocks, fixed income and preferred stocks, providing powerful tools for inflation hedging and long-term value storage. MicroStrategy has been actively acquiring Bitcoin since 2020 and currently holds 252,220 Bitcoins.

✔ Florida CFO advocates adding Bitcoin to state pension funds for strategic growth

Florida Chief Financial Officer Jimmy Patronis has urged the State Board of Administration (SBA) to consider adding Bitcoin to the state pension funds.

On Oct. 29, Patronis sent a letter to Chris Spencer, the executive director of the Florida State Board of Administration, highlighting Bitcoin’s role as “digital gold.” He emphasized how Bitcoin could diversify the state’s portfolio while offering a protective hedge against the volatility of other major asset classes.

Patronis stressed that protecting the financial stability of Florida’s pension funds for teachers, police officers, and firefighters requires securing the best possible returns. He argued that Bitcoin could be a strategic addition, offering a compelling opportunity within the crypto sector.

The CFO pointed out that his proposal aligns with Governor Ron DeSantis’s stance against central bank digital currencies (CBDCs), which contrasts with the decentralized nature of Bitcoin and other cryptocurrencies.

✔ The Russian state and the nation’s biggest crypto miner BitRiver have unveiled plans to build mining data centers in BRICS nations.

Per RBC, the deal involves the Russian Direct Investment Fund (RDIF), the country’s sovereign wealth fund. BitRiver already has 21 data centers in Russia and is building 10 new centers.

🔸 Ethereum

✔ UBS Asset Management launches its first tokenized investment fund on Ethereum

The Union Bank of Switzerland (UBS), the largest private bank in the world, has announced the launch of the "UBS USD Money Market Investment Fund Token" (uMINT) - a tokenised investment fund on the Ethereum blockchain.

Thomas Kaegi, Co-Head of UBS Asset Management APAC, said, “We have seen growing investor appetite for tokenized financial assets across asset classes. Through leveraging our global capabilities and collaborating with peers and regulators, we can now provide clients with an innovative solution.”

Tokenholders can now access UBS Asset Management’s institutional grade cash management solutions underpinned by high quality money market instruments based on a conservative, risk-managed framework.

UBS Asset Management’s global distributed ledger technology strategy is focused on leveraging public and private blockchains networks for enhanced fund issuance and distribution. As an active industry partner of The Monetary Authority of Singapore’s Project Guardian initiative, in October 2023 UBS Asset Management launched a live pilot of a tokenized Variable Capital Company (VCC) fund.

More broadly, this fund launch also forms part of the broader expansion of UBS’s tokenization services through UBS Tokenize where in June 2023, UBS originated CNH 200 million of fully digital structured notes for a third-party issuer. And in November 2023, UBS completed the world’s first cross-border repurchase transaction with a natively-issued digital bond fully executed and settled on a public blockchain.

✔ Previously in March 2024, BlackRock also launched its first tokenized fund issued on Ethereum, the BlackRock USD Institutional Digital Liquidity Fund (“BUIDL”). BUIDL has reached $533M market cap as of today.

✔ OG Ethereum whales selling

A few whales who received large amount of ETH through ICO have been selling ETH on CEXes, contributing to the weak price action of Ethereum this period.

🔸 Crypto Policies & Regulations

✔ The Vietnamese government has identified blockchain as one of the important technological trends of the Fourth Industrial Revolution and is committed to making Vietnam a leading regional blockchain technology research, application and innovation center by 2030.

✔ NYSE Arca seeks SEC approval for Grayscale’s crypto index ETF

NYSE Arca has filed an application with the SEC to list a Grayscale exchange-traded fund (ETF) featuring a diverse array of cryptocurrencies, marking a significant push to expand institutional access to digital assets.

The Grayscale Digital Large Cap Fund, a crypto index portfolio created in 2018, includes popular cryptocurrencies like Bitcoin, Ethereum, and Solana alongside other altcoins. The application follows the firm’s recent Oct. 16 filing to convert the fund into an ETF.

If approved, the Grayscale Digital Large Cap Fund ETF would introduce investors to a mixed basket of digital assets, positioning itself as a more inclusive alternative to traditional Bitcoin or Ether-focused ETFs.

The proposed fund stands out from competitors by tracking the CoinDesk Large Cap Select Index, which includes five distinct digital assets, offering a broader approach for those seeking exposure beyond BTC and ETH.

The fund currently holds approximately $565 million in assets under management (AUM).

✔ SEC crackdown continues with Immutable latest to receive Wells Notice

The SEC has issued a Wells notice to blockchain gaming platform Immutable in what has become a widespread crackdown on crypto companies ahead of the US election.

Immutable said in an Oct. 31 blog post that the move is the latest instance of the SEC’s “regulation-by-enforcement” policy targeting the crypto industry. It added that the watchdog issued the notice without prior discussions

According to Immutable, the SEC’s allegations, though vague, appear to focus on the 2021 listing and private sales of its native token IMX. The network contends that the IMX token does not meet the criteria of a security and that the regulator’s actions bypass meaningful dialogue.

✔ On 8 October, crypto exchange Crypto.com has filed suit against the U.S. SEC. Its decision to sue the SEC follows receipt of a Wells notice from the Commission staff. The lawsuit contends that the SEC has unilaterally expanded its jurisdiction beyond statutory limits and separately that the SEC has established an unlawful rule that trades in nearly all crypto assets are securities except BTC and ETH.

✔ VanEck analyst criticizes US Treasury’s outdated stance on stablecoins

VanEck’s head of digital assets research, Matthew Sigel, criticized a recent US Treasury Department’s views on digital assets in a recent report, claiming it had an anti-stablecoin stance based on outdated academic views.

Sigel stated that the Treasury relied on a single academic study by Gary Gorton and Jeffery Zhang to justify a preference for centralized financial systems. Additionally, he said the study’s US-centric historical analysis promotes a “recycled narrative” that private money is inherently unstable, deeming it misleading.

✔ The Thai SEC has proposed new rules to allow mutual funds and private funds to invest in digital assets, proposing to allow securities firms and asset management companies to provide services to large investors interested in investing in crypto-related products such as ETFs.

✔ The Taiwan Financial Supervisory Commission plans to promote the trial of virtual asset custody business and encourage financial institutions to participate in innovation. Currently, three private banks have expressed interest. It is expected that the first trial application will appear in the first quarter of next year

✔ US Treasury says tokenization, stablecoins will reshape financial landscape but urges caution

The US Treasury Department said tokenization and stablecoins are emerging forces that could transform the Treasury market, emphasizing both the benefits of these innovations and the risks they carry, according to a recent report.

The report noted that as tokenization — the process of representing assets digitally on a blockchain — takes root, the Treasury market could see major advances in efficiency, expanded access for investors, and enhanced transparency.

However, it cautioned that stablecoins, now increasingly reliant on Treasuries for collateral, may pose significant risks if not closely regulated.

✔ Tether hits $7.7 billion in profit YTD as reserves reach record high

Tether Limited reported $2.5 billion in net profit for the third quarter, bringing its year-to-date profits to a record-breaking $7.7 billion.

The firm’s strong third-quarter numbers were primarily boosted by its gold holdings, which amount to roughly $5 billion, recording $1.1 billion in unrealized profit.

According to Tether’s latest assurance opinion, conducted by accounting firm BDO, the firm has raised its excess reserve buffer to over $6 billion, reflecting a 15% growth rate in the past nine months.

✔ Coinbase's Q3 results released last Wednesday were lower than expected. Total revenue for Q3 was $1.21 billion, up 79% YOY and down 17% MOM, lower than the expectation of $1.26 billion; net profit attributable to common shareholders was $75.459 million. Coinbase also announced a stock repurchase plan of up to $1 billion

✔ Tesla released its third quarter financial report for 2024. The company did not sell its $184 million worth of cryptocurrencies this quarter, and has not sold cryptocurrencies for 5 consecutive quarters.

✔ Payments company Stripe has acquired stablecoin platform Bridge for $1.1 billion. Bridge provides software that helps businesses accept stablecoin payments, marking an expansion of Stripe's cryptocurrency adoption efforts. Bridge is Stripe's largest acquisition to date and may also be the largest acquisition in the history of the crypto industry.

✔ Vivek Ramaswamy’s Strive to integrate Bitcoin as hedge against long-term economic risks

Strive Enterprises, an asset management firm co-founded by Vivek Ramaswamy, announced a new wealth management division on Nov. 1 that will integrate Bitcoin (BTC) into client portfolios, according to a Nov. 1 press release.

The move aims to use Bitcoin as a hedge against expected long-term economic risks, including inflation, rising fixed-income yields, persistent geopolitical tensions, and restrictive monetary policies.

According to Strive, Bitcoin is an asset that can offer resilience amid global debt concerns and economic instability.

Sources: CryptoSlate, Wu Blockchain News, Coin68..

Nhận xét

Đăng nhận xét